Sf property tax rate

Bureau of Delinquent Revenue Payment The Bureau of Delinquent Revenue BDR is the official collection. On Monday March 7 2022 the City and County of San Francisco will launch the Be The Jury pilot program in San Francisco Superior Court which will compensate low-to-moderate-income.

Understanding California S Property Taxes

Purchase Price 380000 2020 Property Taxes 5546.

. If you received a letter from the Citys collection agency BDR you must pay it immediately. Businesses must file and pay taxes and fees on a regular basis. The Midland City Council voted Tuesday to approve the 2022-23 budget and tax rate.

The average effective property tax rate in California is 073. Property owners pay secured property tax annually. A Tax Clearance Certificate is a document that certifies there.

This calculator is designed to help you estimate property taxes after purchasing your home. Learn about the Citys property taxes. The secured property tax amount is based on the assessed value of the.

Who and How Determines San Francisco Property Tax Rates. 555 Capitol Mall Suite 765 Sacramento CA 95814. View and pay a property tax bill online.

Business taxes and fees can be paid online by mail in person by ACH or by wire. Property tax property taxes San Francisco Property Taxes sf property tax bill tax questions. How Property Taxes in California Work.

Property taxes are collected by the County Tax Collector for the City and various other taxes are collected by the State and remitted to the City. Danielle Lazier Vivre Real Estate Agents. Before we start watch the video below to understand what are supplemental taxes.

San Francisco County collects on average 055 of a propertys. Our San Francisco County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average. In general unsecured property tax is either for business personal property office equipment owned or leased boats.

The Property Tax Rate for the City and County of San Francisco is currently set at 11801 of the assessed value for 2019-20. For best search results enter your bill number or blocklot as shown on your bill. Enter only the values not the words Block or Lot and include any leading zeros.

A requirement for subdivision and condo conversion is to obtain a Tax Clearance Certificate before the final map is recorded. Bartolini Search homeowner info. Property Taxes 6133 2021 60565 Staghorn Drive La Quinta CA 92253 Current Owners Claudia A.

For questions regarding property tax collection. If you enter your. The unsecured property tax rate for Fiscal Year 2020-21 is 11801.

Those entities include San Francisco the county districts and special purpose units that produce that combined tax rate. The median property tax in San Francisco County California is 4311 per year for a home worth the median value of 785200. This compares well to the national average which currently sits at 107.

The assessed value is initially set at the purchase price. Access and view your bill online learn about the different payment options and how to get assistance form the Citys Treasurer. The City of Midland budget includes 1486 million in General Fund operating expenses.

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

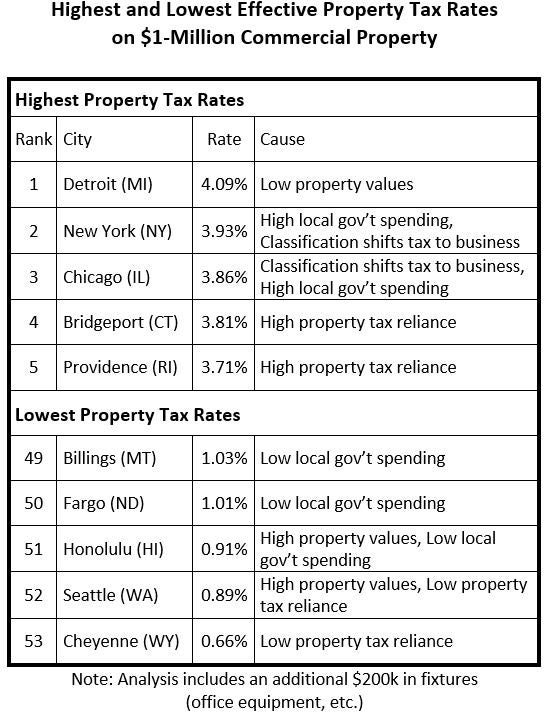

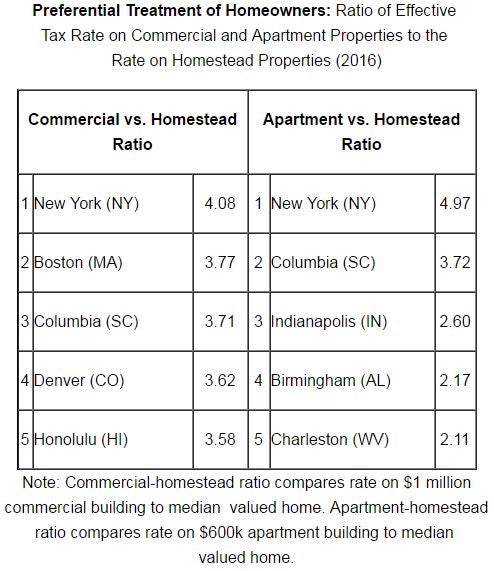

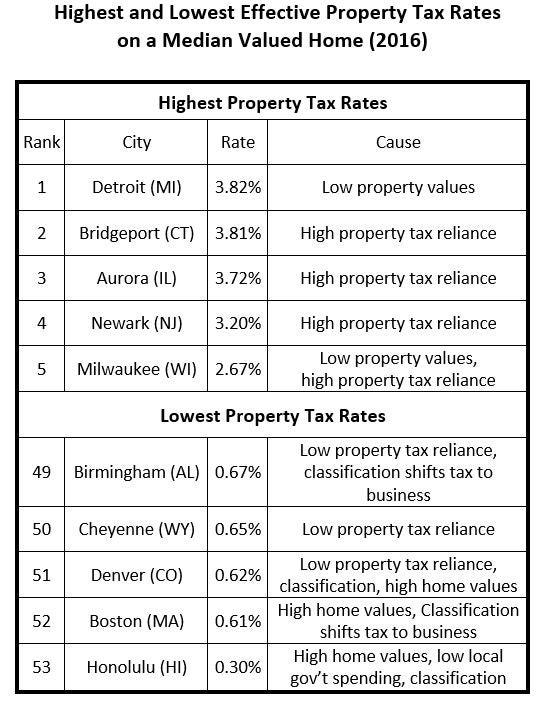

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

2022 Property Taxes By State Report Propertyshark

Property Taxes By State Embrace Higher Property Taxes

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Understanding California S Property Taxes

Secured Property Taxes Treasurer Tax Collector

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Understanding California S Property Taxes

San Francisco Prop W Transfer Tax Spur

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Sf Property Tax Rate Over Time